Here is Inspiration:

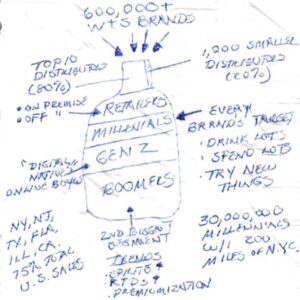

THE U.S. WINE AND SPIRITS INDUSTRY ON A PAPER NAPKIN

I respect experts who dedicate their careers to research, insights and solutions which help us in so many ways. One challenge I hear many share is how to find simple ways to explain what are often complex elements on their subject. It takes a special skill to teach others what they have studied or learned in a simple, understandable way.

My colleague, Dave Perry, is an inspiration for tackling this challenge. An expert in the wine and spirits industry, Dave recently had a lunch with a brand potential investor. While waiting for their meal, Dave outlined the U.S. Wine and Spirits Industry on a paper napkin.

If you’re having trouble reading his chicken scrawl, here is a summary.

- The Industry has more than 600,000 registered W&S brands. This daunting number of participants is trying to enter the market, characterized here, as an alcohol bottle.

- Entrance into the bottle (or market) is controlled at the neck by about 1,210 W&S distributors.

- The top 10 control about 80% of brands going to retailers. 20% is handled by the remaining 1,200. Distributors disperse brands to retailers, both on and off-premise.

- Retailers then make the brands available to consumers. Although there are 50 U.S. states, a majority, 75-80% of total U.S. retail sales can found in just 6 states – NY, NJ, TX, FL, IL, CA. (something to keep in mind when deciding where to launch a brand).

- The consumer segment most targeted by brands is Millennials. This 24-40 year old age group is highly coveted because they 1.) drink a lot; 2.) spend a lot; 3.) like to try new, unfamiliar brands (not a loyal bunch). Looking at a map, if you put a compass point in NYC and drew a circle 200 miles out, you’d find more than 30,000,000 Millennials compacted into this small geographic region (you could almost build a brand focusing on this area.

- The second biggest consumer segment is the 56+ year olds called Boomers. They don’t imbibe as much as Millennials, but they’re close in consumption but far less adventurous in brand exploration.

Lastly, Gen Zs round out the key customer segments. This is the least alcohol-consuming of the three age groups. Yet, they are the first ‘digitally native’ generation, having been raised on the Internet, making them good candidates for online purchasing. - Trends within the Industry include the rise of spirits as a preferred alcoholic beverage, ready-to-drink cocktails and overall – across wine, spirits and beer, premiumization to higher quality, higher alcohol strength brands.

The investor’s response on seeing this paper napkin outline was: ‘How do you successfully compete in an industry with almost three quarters of a million competitors?’

Dave smiled: “That’s when I turn up my creativity and go to work!”

Have a Challenge?

Try sketching it out on a napkin and send it to us. We’re here to provide solutions for success.

2Go Advisory Group provides experts to support clients across a broad set of industries, including agribusiness, wine and spirits, beverages, food, cannabis, consumer products, healthcare, life sciences, real estate and construction, international, technology, professional service and non-profit sectors.

Dave Perry is a 2GO advisor and consultant, providing marketing and sales strategy growth for clients in the food, agriculture and wines and spirits industries.

Dave Perry is a 2GO advisor and consultant, providing marketing and sales strategy growth for clients in the food, agriculture and wines and spirits industries.

Donna Hamlin, Ph.D. is Lead Partner for CHROs2Go, supporting clients with both HR, strategic planning and change management for growth and high performance.

Donna Hamlin, Ph.D. is Lead Partner for CHROs2Go, supporting clients with both HR, strategic planning and change management for growth and high performance.