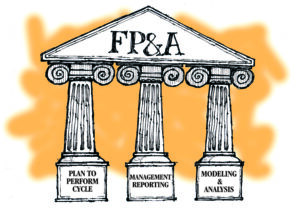

Financial Planning and Analysis (FP&A) is an essential financial activity in companies of all sizes. FP&A provides finance teams with a structured approach to budgeting, forecasting, scenario modeling, and management reporting. These activities are focused on supporting a company’s financial health and demonstrating the link between corporate strategy and execution.

Financial Planning and Analysis (FP&A) is an essential financial activity in companies of all sizes. FP&A provides finance teams with a structured approach to budgeting, forecasting, scenario modeling, and management reporting. These activities are focused on supporting a company’s financial health and demonstrating the link between corporate strategy and execution.

One of the primary limitations of FP&A, up until recently, is that it typically provides only a financial perspective on company performance. That’s where xP&A comes in.

Extended Planning and Analysis (xP&A) builds on the power of FP&A by expanding its capabilities across the entire organization. xP&A becomes a company-wide process, extending the planning behaviors and tools beyond traditional finance by including relevant and timely data from all functions, resulting in a holistic and actionable view of the business.

xP&A promises to deliver many benefits, including:

Visibility – The availability of a transparent total company view provides insight into the company’s risks and opportunities, including customer pipeline, inventory levels, accounts receivable aging, and the related cash management implications.

Collaboration – xP&A is fundamentally about eliminating the various silos within an organization to enable a shared vision of success across all key functional areas, facilitating integrated strategic and operational planning.

Alignment – The integration of data and processes combined with a common vision of success makes it easier to optimize decisions and activities. The result is a shared understanding, across departments dealing with differing priorities, about which activities contribute the most to the overarching goal of improving total company performance.

Agility – One of the many lessons from 2020 was that the businesses that fared the best quickly adapted to changing market conditions and opportunities. With xP&A deployed across the company, business leaders have access to real-time information that facilitates continuous updates to forecasts and allocation of resources, significantly increasing organizational agility.

While the xP&A acronym is of recent origin, the concept isn’t new. The primary barrier to implementation has been technology related. Achieving real-time visibility to data across the entire organization requires robust planning technology that supports collaboration among operational and finance teams in a variety of areas, including forecasting and scenario modeling.

The technology needs to deliver reliable, secure integration with the company’s software systems for marketing, CRM/sales, ERP, market trends, competitive insights, and more. The platform also has to be flexible enough to adapt to each function’s different needs while preserving data integrity and process control. The good news is that cloud-based software solutions delivering xP&A capabilities are becoming significantly more robust and affordable, gradually bringing the promise of xP&A to companies of all sizes.

Fulfilling the promise of xP&A requires more than technology and vision. The most critical element for a successful implementation is the buy-in and active support from the leadership team and the heads of all functions across the company. It needs to be understood across the organization that this is a company-wide initiative with the potential to impact the future success of the business significantly.

Another critical success factor is ensuring that the implementation team engages with each of the various functions to understand the data and metrics essential to their business and make a clear linkage with how the related activities contribute to the company’s overall success.

It’s a safe bet that one lesson every company learned in 2020 is that agility is essential not just to survive but to thrive. The ability to quickly pivot to manage the opportunities and risks associated with fluctuating market conditions can be a critical competitive differentiator. xP&A can provide business leaders with the real-time data they need to make timely, informed decisions in the face of change.

At CFOs2GO, we’re ready to provide the support you need to improve your FP&A processes and position your company on the path towards xP&A success.

Joe leads the firm’s Financial Performace Management practice area. A versatile financial professional, Joe has broad experience in FP&A, investor relations, and financial operations management and process improvements that drive increased efficiency and cost savings. He is well-regarded for his communication skills within organizations and with investors and banking partners.

Joe leads the firm’s Financial Performace Management practice area. A versatile financial professional, Joe has broad experience in FP&A, investor relations, and financial operations management and process improvements that drive increased efficiency and cost savings. He is well-regarded for his communication skills within organizations and with investors and banking partners.

If you would like to speak with Joe, please use the Comments section to make a request.