In the 90’s, I was the head of finance for a US company’s European operations. Before the advent of the Euro, we had to deal with operations in Dutch Guilders, Belgian Francs, French Francs, British Pounds, German Deutsche Marks, Italian Lira and Spanish Pesetas. Keeping track of each and consolidating them into our European and then the parent company’s books offered challenges. Exchange rates changed constantly and budgets and plans we prepared as much as a year ahead could be stymied just due to these exchange rate shifts.

In the 90’s, I was the head of finance for a US company’s European operations. Before the advent of the Euro, we had to deal with operations in Dutch Guilders, Belgian Francs, French Francs, British Pounds, German Deutsche Marks, Italian Lira and Spanish Pesetas. Keeping track of each and consolidating them into our European and then the parent company’s books offered challenges. Exchange rates changed constantly and budgets and plans we prepared as much as a year ahead could be stymied just due to these exchange rate shifts.

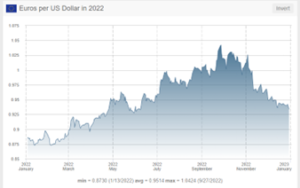

US Companies with international operations, which operate in local currencies, have the challenge of changes in exchange rates throughout the year. When rates are volatile, this can have a disproportionate effect on results – making actual performance seem better or worse simply because of exchange rate fluctuations. While the Euro has made cross-border operations in Europe much more straightforward, the dollar and euro did move significantly in 2022 and could have caused fluctuations in profitability.

Graph from https://www.dollarfx.org/Euro/2022

The use of “Plan Rates” can identify actual performance irrespective of volatility in exchange rates. The following examples illustrate how we can use Plan Rates to analyze actual performance.

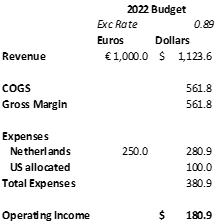

Let’s say, for example, you have an operation in the Netherlands with sales and administrative expenses in Euros, but you are selling your US manufactured product. If you prepared your budget in December of 2021 when the exchange rate was € 0.89 to $1.00, for 2022, you would have assumed that sales of €1.00 million would result in equivalent sales of $ 1.12 million. Also, your expenses of € 250 thousand would result in equivalent expenses of $280 thousand. Your budget might have looked like this:

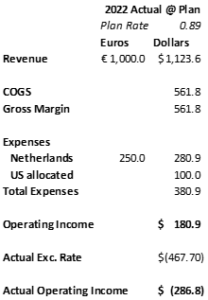

Through the course of the year though, the dollar strengthened against the Euro. For illustration, lets assume the average exchange rate was € 2.00 to $1.00 (actual in 2022 was more along the lines of €0.95). If you were exactly on budget otherwise, your results would have been:

Turning an otherwise decent profit for the Dutch subsidiary into a loss just due to exchange rate swings.

What many companies do is adopt a “Plan Rate” for performance purposes. While not GAAP, this allows the evaluation of the subsidiary without the uncontrollable exchange rate fluctuations. While the P&L above is how we should present according to GAAP (with appropriate footnotes regarding currency exchange rates and balance sheet adjustments), the following is how we might gauge the performance of the subsidiary:

Your accountants won’t accept this presentation of financial results for reporting and consolidations, but when you have your year-end meeting with the managers of your foreign subsidiary, this is a much fairer way to evaluate their financial performance.

Gordon Rogers has spent the better part of three decades either living and working overseas, working for foreign companies, or managing the international operations for US companies. If you are a US company with foreign operations or a foreign company with business operations in the United States, Mr. Rogers can help you navigate the challenges of operating in multiple currencies and jurisdictions.

Gordon L. Rogers is a partner at 2Go Advisory Group in their Health and Life Science Practice Area. He brings a wealth of experience spanning all facets of business from manufacturing to sales and corporate affairs and has significant international experience. Much of his career was in medical technology.

Gordon L. Rogers is a partner at 2Go Advisory Group in their Health and Life Science Practice Area. He brings a wealth of experience spanning all facets of business from manufacturing to sales and corporate affairs and has significant international experience. Much of his career was in medical technology.